As Hollywood actors and writers strike collectively for the primary time since 1960 over pay, working circumstances, and job safety, Disney has purged dozens of unique TV exhibits and films from its streaming platforms, in a transfer that hurts staff and provides subscribers fewer choices to look at.

Disney claims it must destroy the content material to chop prices on platforms that aren’t making a living, however consultants say the corporate is overstating the worth of its content material — which may in the end assist the corporate pocket a better tax break.

In Could, Disney informed regulators that it’s going to incur $1.5 billion in losses as a part of its content material purge. Disney’s chief monetary officer Christine McCarthy informed traders Disney was making “wonderful progress on our cost-cutting initiatives,” on its Could earnings name, together with “eradicating sure content material from our streaming platforms.”

However that $1.5 billion quantity is elevating eyebrows amongst business consultants, who query how Disney can concurrently declare that it’s purging content material as a result of it wasn’t price the associated fee, whereas additionally asserting the transfer will result in a staggering $1.5 billion in losses. There may be an apparent upshot to this method: The larger hit that Disney claims, the bigger the potential tax writeoff for the corporate.

Watch The Lever Be sure you’re subscribed to The Lever on YouTube to get our newest video experiences and different particular content material. Click on Right here To Watch & Subscribe Now

“Within the context of Disney streaming, the place income is pushed by subscriber numbers and churn charges, it pushes the boundaries of credibility that any of the exhibits eliminated may have had this massive an influence,” stated Aswath Damodaran, a professor of finance at New York College’s Stern College of Enterprise. “I don’t suppose it makes any sense for any firm to take content material off a streaming platform if it creates $1.5 billion in worth. As a result of, as a enterprise, why would you do this?”

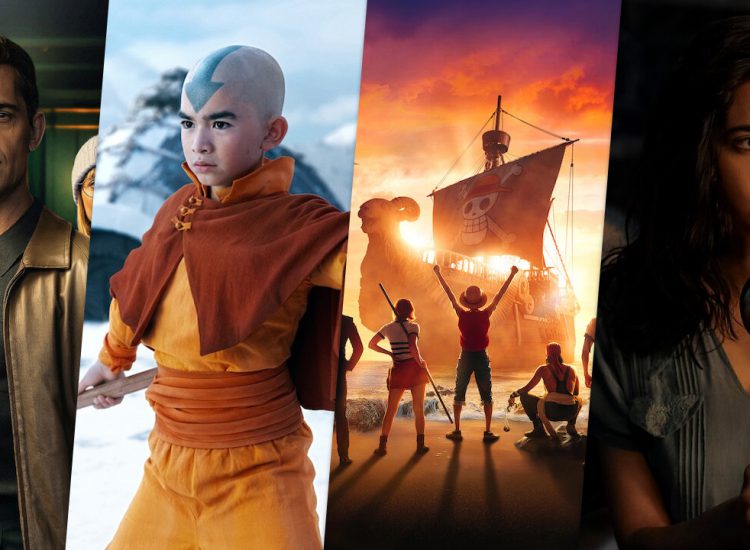

Disney’s streaming platforms, Disney+ and Hulu, usually are not the one platforms which were purging content material from their libraries. Final yr, Warner Bros and HBO Max undertook the primary large purge within the business following the merger between the 2 firms, eradicating dozens of titles — reportedly to avoid wasting on residuals and different prices. This spring, Paramount + additionally eliminated unique content material from their platform.

Past the tax writeoffs, eradicating content material that isn’t serving to platforms retain or usher in new subscribers is a strategy to reduce spending on residual funds to writers and actors in addition to keep away from paying licensing prices. It provides insult to damage for hanging staff, who warn that a number of consolidated streaming platforms have slashed employee pay, worsened working circumstances, and made employment extra erratic, and who see additional cuts to their already meager streaming residuals when exhibits are purged.

Disney’s strikes come as CEO Bob Iger, who has made $499 million over the previous 5 years, has promised main cost-cutting efforts on the firm — together with 7,000 layoffs — and referred to as the actors and writers’ honest pay calls for “not reasonable.”

However consultants say the IRS shouldn’t let Disney take a tax writeoff for the newest content material purge.

“In case you take a exhibit as a result of persons are not watching it, you possibly can’t in good conscience flip round and declare a billion {dollars}, and even $100 million, since you’re taking it off as a result of persons are not watching it,” stated Damodaran.

Disney didn’t reply to requests for remark.

A Confounding $1.5 Billion Calculation

It’s objectively tough to say how a lot one specific present or film on Disney+ or Hulu is price, since Disney measures the efficiency of these platforms when it comes to total subscriber progress and churn — which is one motive why consultants are skeptical concerning the math behind Disney’s content material purge.

In late Could, Disney informed regulators and traders in a public submitting that it might be taking down “sure produced content material from its [direct-to-consumer] providers. Because of this, the corporate will report a $1.5 billion impairment cost.” Disney warned that “extra produced content material can be eliminated” and will create a further $400 million impairment cost.

Crater, a well-reviewed, touching film about children on a lunar mining colony, was one of many “extra produced content material” casualties that was faraway from Disney+ in July. Disney spent $53 million producing the movie, and it was obtainable for streaming for simply seven weeks.

👉 Assist us develop by following us on social media:

• Fb

• YouTube by following us on social media:

In easy phrases, when Disney produces a film like Crater, the corporate has created an asset that can have worth over the course of what accountants name its helpful life. For tax functions, Disney is required to unfold the price of the asset over the course of its helpful life by means of what is called “amortization.”

However when Disney declares that the asset has change into nugatory extra shortly than anticipated — and contributes to its worthlessness by making it unavailable to stream — the corporate should report what is called an “impairment cost” to replicate the writeoff within the asset worth.

Outdoors observers say that the numbers don’t add up behind Disney’s determination to take down the exhibits and declare a $1.5 billion impairment cost. That’s as a result of Disney is claiming two contradictory issues: Each that the belongings have been least producing so little worth that it’s cheaper to destroy them than to maintain them, and that the belongings have been price $1.5 billion.

There’s a further motive the quantity is confounding: The 2017 tax invoice contained an enormous company giveaway generally known as “bonus depreciation,” which briefly allowed firms to expense the prices of belongings up entrance, somewhat than requiring them to amortize the prices over time.

That provision has allowed simply 25 main firms to avoid wasting $67 billion on their taxes since 2017, in keeping with a latest report by the Institute for Taxation and Financial Coverage. A type of firms, Disney, has saved billions of {dollars} on tax breaks from bonus depreciation.

“I can not determine how they will presumably get to $1.5 billion, as a result of they need to have virtually no unamortized prices,” beneath the 2017 tax invoice, stated David Offenberg, a professor of leisure business finance at Loyola Marymount College. The exception is that foreign-made exhibits and films weren’t eligible for the tax break.

Offenberg stated it’s potential that Disney is together with in that $1.5 billion quantity “motion pictures that they launched in 2023, that haven’t labored out the best way they thought they might, with out acknowledging that they’re taking an enormous writedown on all of those misses.” One such film is Elemental, which price greater than $200 million to make and flopped on the field workplace.

Getting into The Reminiscence Gap

Nevertheless Disney arrived on the quantity, the corporate will have the ability to declare a tax writeoff and the IRS isn’t prone to ask questions. Whereas the $1.5 billion exhibits up as an incomes hit, the corporate stands to learn for tax functions as a result of it lowers Disney’s taxable earnings.

“I don’t even know what they’re writing off,” stated Damodaran, noting that motion pictures and TV exhibits don’t seem on Disney’s stability sheet — which as an alternative measures income when it comes to subscriber progress and churn.

“So if I have been the IRS,” he stated, “I wouldn’t enable them to take a single cent of the $1.5 billion.”

The IRS doesn’t have a great report of company tax enforcement after years of funds cuts — though it noticed a funding enhance for enforcement within the Democrats’ Inflation Discount Act final summer season. Over the previous 4 a long time, as company earnings have steadily elevated, company tax funds have remained about the identical, in keeping with a latest report from the nonpartisan Congressional Funds Workplace (CBO). Between 2010 and 2018, audit charges for companies with belongings of greater than $20 billion {dollars} fell from practically 100% to about 50 %, in keeping with the CBO.

Over the previous 5 years, Disney has paid a single-digit company earnings tax fee, regardless of making practically $40 billion in earnings over that very same interval.

“The way in which that exhibits are amortized is basically as much as the producer,” stated Offenberg. “They must make good-faith estimates of how a lot they suppose the present goes to earn over its lifetime, and the IRS can not presumably become involved in figuring out the earnings of a particular present over its lifetime. That’s manner past the scope of their capabilities, they must depend on firms to do their greatest to report these numbers.”

The place actors and screenwriters see the product of years of onerous work and their sources of earnings, platforms see prices to be reduce and potential tax breaks.

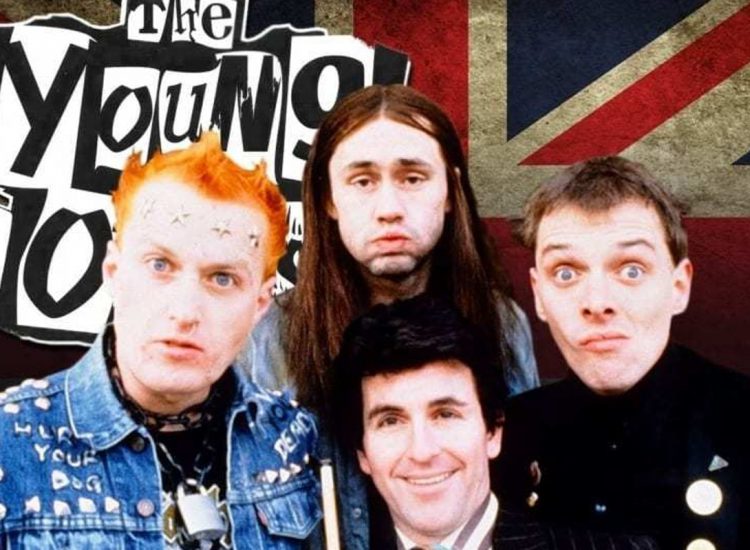

The brand new fantasy journey TV collection Willow, starring Warwick Davis, was one in all Disney’s most-watched and beloved new exhibits this yr. “This present is enjoyable,” wrote Alex Cranz for The Verge.

However in Could, simply six months after it was launched, Disney+ abruptly eliminated Willow from its choices, and now the present can’t be accessed anyplace.

“They gave us six months. Not even. This enterprise has change into completely merciless,” tweeted John Bickerstaff, a author on Willow, following Disney’s announcement.

When Willow was faraway from the library, residual funds to the present’s writers and actors ceased. And now, the present can’t be accessed anyplace — by its creators and by audiences.

The Hollywood Reporter has termed this second streaming’s “memory-hole period.” Disney and different streamers are dedicated to chopping prices, discovering tax breaks, and returning cash to shareholders — not making certain creators’ work stays obtainable to the general public in perpetuity.